How Prospective High School Graduates Are Cutting College Costs

Smarter College Planning: What Gen Z Is Doing Differently

If there’s one thing every generation shares, it’s the belief that they’ve figured things out better than the last one. While life isn’t a competition, we do learn from our elders — like avoiding over-plucked eyebrows (thanks, 2000s), or realizing that a good gym session involves more than just bicep curls (looking at you, 80s).

As Gen Z rounds the corner into adulthood, they’ve already started calling out millennials — from side parts and skinny jeans to how they handled financing college. It’s no wonder: 14.8 million millennials carry student loan debt, with an average balance of nearly $40,000. With private college tuition averaging $70,000/year and state schools nearing $35,000/year, higher education can quickly become a burden — right when life should feel full of opportunity.

Whether you or your kids are already in school, or just beginning to plan, here are smart, forward-thinking strategies to avoid the pitfalls of student debt.

Saving Ahead of Time

While paying for higher education is often a family affair, about 62% of Gen Z prospective students are also building their own savings for education. That’s a strong move — and where you save matters.

In addition to standard options like mutual funds or CDs, consider 529 plans. These state-sponsored accounts are specifically designed for education costs and come with tax advantages:

Prepaid Tuition Programs: Lock in tuition rates at eligible state colleges (some private out-of-state schools qualify too). Contributions can be made as lump sums or monthly installments.

College Savings Programs: More flexible. Funds can be used at any accredited U.S. college, and grow tax-deferred with tax-free withdrawals when used for qualifying expenses.

Keep in mind:

There’s a penalty for non-educational withdrawals.

529 funds count toward financial aid eligibility.

Custodial 529s can be managed by parents or guardians, with the student as the named beneficiary.

Alternatives to Loans

Even saving $2,500 per year in loan expenses adds up — not to mention interest savings. Before assuming loans are inevitable:

Apply for Financial Aid: This includes institutional grants and federal assistance.

Hunt for Scholarships: Many exist outside your school, and most allow reapplication. The time investment is often worth thousands in savings.

Get a Part-Time Job: On-campus or off-campus jobs help reduce debt and add real-world experience.

Minimize Living Costs: Tap into school-included amenities like gyms or rec centers, cook at home, and choose more affordable housing.

Graduate Early: If you’ve earned college credit in high school, check if you can finish a semester early — saving money and jumpstarting your career.

Prioritize Loans Wisely: If loans are needed, go for subsidized federal loans first. Avoid private loans whenever possible due to higher interest and fewer protections.

Alternative Routes

Gen Z is breaking the mold — and that’s not a bad thing.

36% plan to attend community college first, to save money and evaluate goals.

31% plan to take a gap year to earn and reflect before committing.

20% are exploring alternatives to college entirely, such as trade school or entering the workforce.

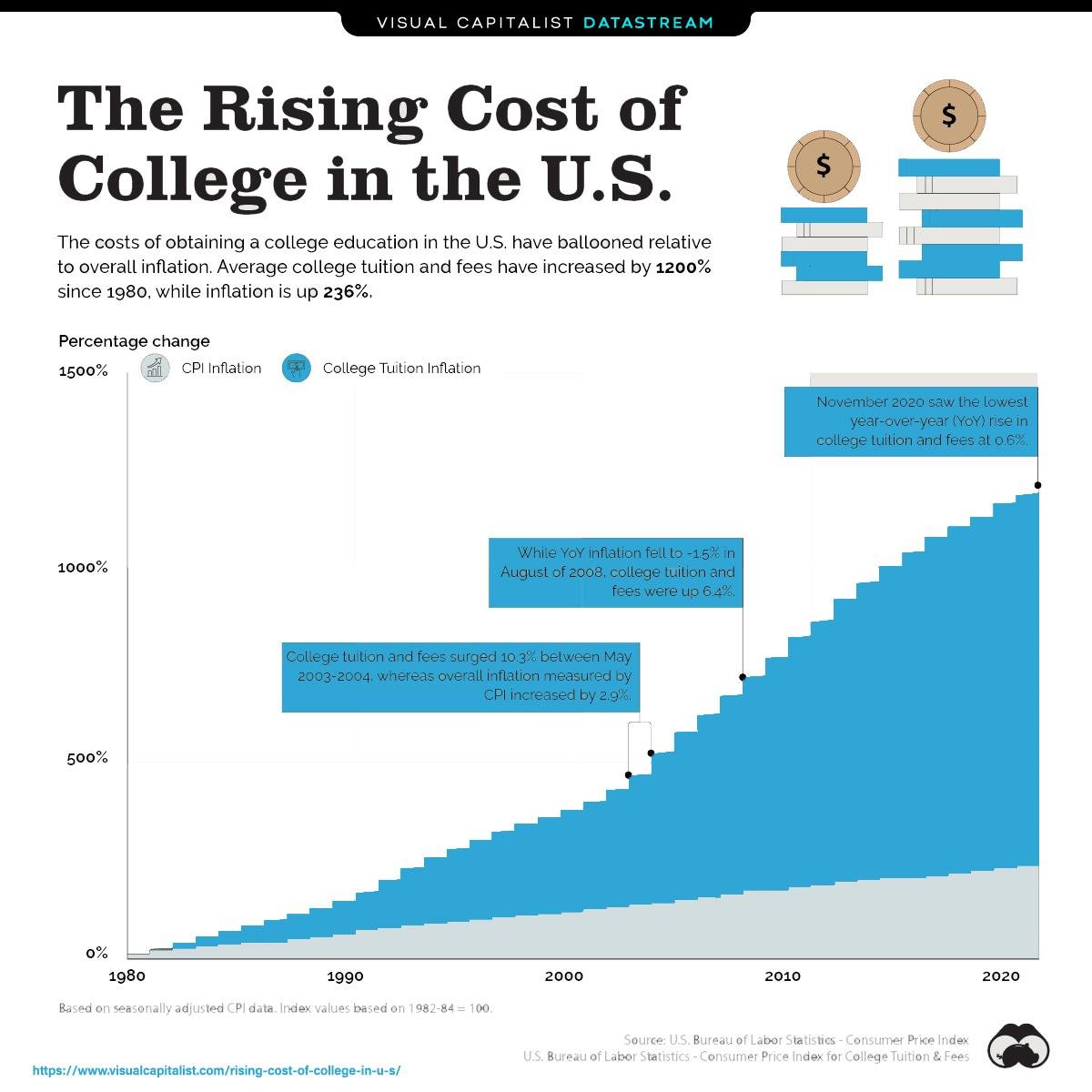

Since college costs have jumped 1,200% since 1980, it’s not surprising that more students are evaluating the return on investment. Higher education is still an option — but it’s not the only one.

And some are choosing to build something of their own, starting businesses or pursuing freelance paths. Gen Z is proving that adulthood isn’t a one-size-fits-all journey. Whether it’s a four-year school, trade program, or launching a venture, it all requires smart planning and clarity.

NEST Can Help

At NEST Financial, we’re passionate about helping people find and fund their purpose. Whether you’re saving for school or exploring a less traditional path, a personalized financial plan can give you the confidence and tools to move forward.

📩 Start a conversation: info@nestfinancial.net

💬 Connect with us: LinkedIn | Facebook | Yelp | Twitter

DISCLAIMER: The information shared in this article is for educational purposes only and does not constitute financial or investment advice. For personalized guidance, reach out at info@nestfinancial.net.