How Tax Planning Can Make or Break Your Franchise

Why is Tax Planning Vital for Franchise Owners?

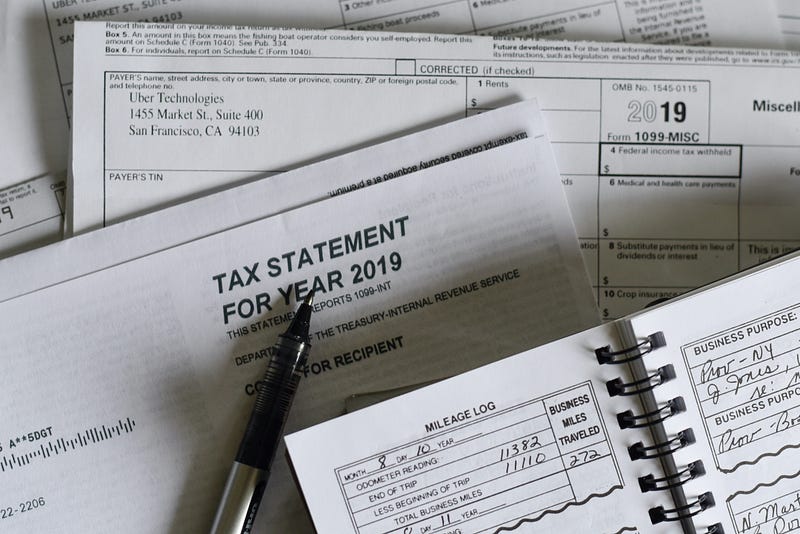

Tax planning is like the GPS for your financial journey, guiding you through a landscape filled with both challenges and opportunities. While you navigate your franchise’s profitability, tax planning helps you avoid common pitfalls, such as penalties for late payments or inaccuracies. Not only does it steer you clear of these financial roadblocks, but it also leads you towards beneficial pathways, like deductions or tax credits, that you might not even know existed.

In addition, tax planning gives you a clearer picture of your cash flow, helping you manage funds more effectively. Without effective planning, you risk making impulsive financial decisions that could lead to costly mistakes. These can add up over time, eating into your profit margins and potentially stunting your franchise’s growth. In extreme cases, poor tax planning can even result in legal issues, causing irreparable damage to your business reputation.

Common Pitfalls in Tax Planning for Franchise Owners

- Underestimating Tax Liabilities: Often, franchise owners may underestimate the amount of tax they owe, leading to insufficient funds when tax payments are due. This can result in penalties and added interest.

- Overlooking Deductibles: Franchise owners may miss out on valuable deductions such as expenses on equipment, property lease, or even marketing costs. Neglecting these can lead to paying more tax than necessary.

- Inaccurate Record-Keeping: Proper and consistent documentation is crucial. Failure to maintain accurate records can lead to discrepancies during audits, potentially resulting in fines or legal issues.

- Lack of Awareness of Tax Credits: Franchise owners might not be aware of tax credits that they're eligible for, such as credits for hiring certain employees or investing in energy-efficient equipment.

- Procrastination and Late Filings: Waiting until the last minute to prepare and file taxes can lead to rushed decisions and overlooked details, potentially leading to penalties for late filing.

- Inadequate Professional Advice: Sometimes, franchise owners might not seek professional advice believing they can handle tax planning themselves. This can result in overlooking complex tax codes and regulations that could be leveraged for financial benefit.

- Failure to Adapt to Tax Law Changes: Tax laws and regulations can change frequently. Failing to stay updated and adapt to these changes can result in compliance issues and missed opportunities for tax savings.

Why is Avoiding These Pitfalls Essential?

Avoiding these common pitfalls underscores the importance of meticulous tax planning. By being proactive, franchise owners can ensure they make the most out of their financial situation, safeguarding their enterprise against avoidable losses and simultaneously exploring avenues for savings and growth. Hence, careful tax planning is indeed the GPS guiding franchise owners through the intricate landscape of taxation, leading to a more prosperous and secure financial journey.

The Basics: Understanding Your Tax Obligations

To truly master tax planning, you first need to understand your tax obligations. This starts with identifying the types of taxes your franchise is subject to, which can range from federal income taxes to local business licenses and permits. The tax obligations can also vary widely depending on your franchise type, location, and the specific services or products you offer.

For instance, if your franchise has a physical presence in multiple states, you may be subject to different state tax laws, each with its own set of rules and rates. Moreover, certain services or products might be tax-exempt in one location but not in another. Grasping these nuances is crucial, as it not only helps you in accurate filing but also in identifying tax-saving opportunities. The better you understand these obligations, the more effectively you can plan your tax strategy, making the most out of available deductions and credits.

1. Federal Taxes:

- Income Tax: All businesses, including franchises, must file an income tax return annually. The structure of your franchise—whether it's a corporation, partnership, or sole proprietorship—will determine the tax forms you need to fill out.

- Employment Taxes: If your franchise has employees, you're responsible for employment taxes, which include Social Security, Medicare, federal income tax withholding, and Federal Unemployment Tax Act (FUTA) taxes.

2. State and Local Taxes:

- Sales Tax: Depending on your location, you may be required to collect, report, and pay sales taxes on the goods or services you sell.

- Property Tax: Franchises with a physical location may have to pay property taxes, which can vary significantly across different municipalities.

- State Income Tax: Some states impose their own income taxes on businesses. Understanding the rates and rules is crucial for compliance.

3. Multi-State Operations:

- Nexus: Having a presence (or "nexus") in multiple states means you may be subject to different state tax laws. It's crucial to understand the tax implications in each state your franchise operates.

- Apportionment: Some states require multi-state businesses to apportion their income, which involves dividing your total income among the states where you operate based on factors like sales, payroll, or property.

4. Industry-Specific Taxes:

- Excise Taxes: Certain industries, such as alcohol or tobacco, may be subject to excise taxes. These are often passed on to the consumer but must be collected and paid by the franchise.

5. Licenses and Permits:

- Business Licenses: Many local jurisdictions require businesses, including franchises, to obtain and periodically renew business licenses.

- Health and Safety Permits: Depending on your products or services, you may need specific permits ensuring compliance with health and safety regulations.

6. Tax Exemptions and Credits:

- Product-Specific Exemptions: Some products or services may be tax-exempt in certain locations. Being aware of these exemptions can help in accurate filing and identifying tax-saving opportunities.

- Tax Credits: Various credits may be available at federal, state, or local levels, such as energy credits, job creation credits, or research and development credits.

Understanding and Leveraging Your Tax Obligations

Having a solid grasp of these tax obligations is the first step towards effective tax planning. By understanding the nuances of each tax type, franchise owners can ensure accurate filing, avoid penalties, and strategically leverage deductions and credits. This knowledge empowers franchisees to optimize their tax strategy and positions them for financial success.

Strategic Tax Planning: Leveraging Deductions and Credits

Effective tax planning goes beyond mere compliance and transforms into a strategic advantage for franchise owners. By understanding and leveraging deductions and credits, franchisees can significantly enhance their financial position.

1. Deductions: Maximizing Business Expense Write-offs

- Business Expenses: Regular operational costs, from utilities to marketing expenses, can be deducted from your taxable income. Keeping meticulous records of these transactions is essential.

- Startup Costs: Franchise owners can deduct certain startup expenses, such as franchise fees, legal fees, and other costs associated with opening a new business.

- Depreciation: Assets like equipment, furniture, or property can be depreciated over time, allowing owners to spread out the deduction and lower their taxable income each year.

2. Tax Credits: Tapping into Incentives

- Hiring Credits: Some tax credits incentivize hiring specific demographics, such as veterans or individuals from low-income backgrounds. These credits can offset your federal tax liability.

- Energy Efficiency Credits: Franchises investing in energy-efficient improvements may be eligible for tax credits, promoting eco-friendly practices while saving money.

- Research and Development Credits: Franchises that invest in innovation may qualify for R&D credits, encouraging the pursuit of new solutions and services.

3. Year-End Planning: Timing for Tax Efficiency

- Deferring Income: By strategically deferring income to the next tax year, franchisees can potentially place themselves in a lower tax bracket.

- Accelerating Expenses: Conversely, by prepaying certain deductible expenses, businesses can reduce their taxable income for the current year.

4. Capital Gains Management: Strategic Investment Decisions

- Asset Disposal Timing: The timing of selling or disposing of assets can influence capital gains taxes. Understanding when to make these moves can optimize tax positions.

- Loss Harvesting: Franchisees can offset capital gains by strategically realizing capital losses, thereby minimizing tax liability.

5. Retirement Planning: Contributing for Future Stability

- Retirement Contributions: By contributing to retirement accounts like a 401(k) or an IRA, franchise owners can not only secure their future but also reduce their current taxable income.

Incorporating these strategic tax planning elements allows franchise owners to transform tax obligations into opportunities for savings and growth. By actively managing deductions, credits, and investments, franchises can strengthen their financial standing and pave the way for long-term success.

Elements to Consider for Multi-Location Franchises

State-Specific Tax Laws

Operating franchises in multiple locations adds layers of complexity to your tax planning. One critical factor is state-specific tax laws. For example:

- Some states impose franchise or business privilege taxes.

- Others offer tax incentives for certain industries.

Income Allocation Across States

Income allocation becomes tricky when dealing with multi-state operations. You must understand ‘nexus’ rules that decide how much tax is owed to each state based on:

- Proportion of total sales

- Payroll amounts

- Property values within the state

Inventory Taxes

Taxes on inventory can also differ based on location. Key points to consider:

- Where your inventory is stored

- Where your main sales happen

Sales Tax Complexity

Sales tax is another layer to this intricate puzzle. Factors to consider:

- Federal sales tax remains consistent.

- State sales tax can differ widely.

- Sales tax collection is based on the state where the sale is finalized.

Local Taxes

Don’t overlook local taxes, like city or county levies, which can impact your bottom line. Points to keep in mind:

- Local taxes can add up quickly.

- High-tax municipalities can significantly affect profitability.

Getting Expert Franchise Tax Guidance

Why Seek Professional Help?

Tax laws are complex, ever-changing landscapes that require focused expertise to navigate successfully. Even if you consider yourself business-savvy, the nuanced world of taxation can present challenges that are easily overlooked. Here are some reasons why expert franchise tax guidance is invaluable:

- Staying Updated: Tax laws and regulations are constantly evolving. An expert ensures you’re always in compliance.

- Risk Mitigation: Incorrect filing or overlooked deductions can lead to penalties. A tax advisor minimizes these risks.

- Strategic Planning: A tax expert can help develop long-term strategies to optimize your tax position.

Areas of Expertise

Tax professionals can provide guidance in numerous areas, such as:

- Filing Requirements: Ensuring all necessary forms and documents are submitted accurately and on time.

- Deductions and Credits: Identifying potential tax-saving opportunities you may not be aware of.

- Multi-state Operations: If you operate in several states, each will have its own tax laws. A tax advisor can manage these complexities for you.

Frequently Asked Questions (FAQs) about Franchise Tax Planning

What are ‘nexus’ rules in multi-state tax planning?

‘Nexus’ rules dictate how much tax is owed to each state where you operate. This is often calculated based on a proportion of total sales, payroll, or property values within each state.

Are there any tax incentives for franchises?

Some states offer tax incentives for businesses in certain industries. Always consult with a tax advisor to identify possible tax-saving opportunities.

What are local taxes and should I be concerned?

Local taxes, such as city or county levies, can add to your tax burden. They are often overlooked but can add up quickly, especially in high-tax municipalities.

Can a tax advisor help with long-term tax planning?

Yes, a tax advisor can help you develop long-term tax strategies that go beyond yearly filing, optimizing your overall tax position.

Conclusion

In the competitive world of franchising, proper tax planning can be your lifeline. It helps you make the most of tax benefits, avoid unnecessary costs, and keeps you compliant with the law. Don’t underestimate the power of well-executed tax planning; it could very well make or break your franchise.

This article is brought to you by the wizard behind the scenes with 23 years of experience, Dan Dillard. Of course with his workshop of helpers including some handy hi-tech sourcing.

If you’re finding it challenging to stay on top of all the changes, connect with our financial planning professionals by scheduling a no-obligation call. At NEST Financial, we can help make crypto not quite so cryptic.

Find us on:

LinkedIn Facebook Yelp Twitter

If you like reading more entrepreneurial stories In Austin check out Dan's other company foundingAustin. If you are into podcasts click here.

DISCLAIMER: We are legally obligated to remind you that the information and opinions shared in this article are for educational purposes only. These are not financial planning or investment advice. For guidance about your unique goals, drop us a line at info@nestfinancial.net