If there’s one thing that every generation has in common, it’s that they think they do things better than the previous generation. And while life is not a competition, it’s obvious that we learn things from our elders – not to over pluck our eyebrows, for example (thanks 2000s fashionistas!), or that a solid workout in the gym requires more than just bicep curls (looking at you, 80s meatheads). As Gen Z rounds the corner from childhood to free-thinking 18 year olds, they’ve already been calling out millennials on a handful of choices they’ve made, including the side part, skinny jeans, and how their generation approached financing college.

14.8 million millennials have student loan debt, with an average balance of almost $40,000. With the most expensive private tuition averaging around $70,000 a year and state school tuition nearing $35,000 a year on average, the astronomical cost of higher education can weigh heavily on young adults during a time that should feel exciting and full of opportunity. Whether you or your children are already in school or are approaching the time in life where you have to think about that next move, we’ve compiled some tips regarding college that might help new students learn from those that graduated before them and avoid the miry pit of despair known as student debt.

Saving Ahead of Time

While paying for higher education is often a family affair, about 62% of Gen Z prospective students are also starting their own personal savings fund for college expenses. This forward-thinking move can be optimized by placing your savings in the right account. In addition to the usual suspects such as mutual funds and certificates of deposit, potential students and their families can also explore 529 plans.

These state-sponsored accounts are specifically designed for higher education expenses, and they allow you to contribute higher sums than other savings alternatives and also offer tax benefits. There are two 529 account options: prepaid tuition programs and college savings programs. Prepaid tuition programs lock in tuition rates at eligible state colleges and universities (some private out-of-state schools are also eligible, depending on your state) and enable you to invest a lump-sum of money or monthly installments to be applied toward this tuition rate. A College Savings Program is more flexible, as contributions vary and the value of the account can be applied to any accredited higher education institution in the US.

These funds grow tax-deferred, and withdrawals are tax-free if they are used for qualified education expenses. Custodial 529 accounts can be managed by the parents or guardian of a minor, as long as the minor is named as the beneficiary of the account. A couple things to keep in mind – there’s a penalty for early withdrawal, and these funds will be factored into your financial aid eligibility as well.

Alternatives to Loans

Cutting down on loans as much as possible has an exponential positive affect on your finances. Even saving $2500 in loans per year adds up to at least $10,000 by the end of your college education, and even more considering interest. Before assuming that loans are your only option, apply for financial aid – and look for scholarships.

Higher education institutions have scholarship funds, but there are also a lot of scholarship opportunities that are independent of specific colleges and universities. If you don’t qualify for them one semester, you can always reapply and try again the next semester. You never know what you might qualify for, and while it does take a lot of research and time to find appropriate scholarships and apply for them, it doesn’t take a math major to see that spending 10 hours researching and applying is a great time investment if it saves you $10,000.

Part-time jobs on or off-campus are also great ways to abate the cost of college, and has the added bonus of giving you or your student real-life work experience before they graduate, too. Cutting down on living expenses such as housing, food, and lifestyle purchases will also minimize the cost of college. Universities and colleges also have a lot of services and amenities included in tuition – such as gyms and recreational activities – so make sure to save money by taking advantage of these where possible.

If you or your student earned college credit from advanced high school classes, see if graduating a semester early is an option. This can save you a significant amount of money, not to mention give you a head start in your field and allow you to earn your first paycheck months earlier, too.

If you do need to take out loans, opt for subsidized loans before unsubsidized, and avoid private loans at all costs.

Alternative Routes

Gen Z has also learned that the expectation to enter a 4-year college immediately after high school is not necessarily the best option for every person. 36% of Gen Z prospective students stated that they would attend community college before committing to a 4-year college to assess their goals and cut costs, and 31% similarly said they would take a gap year after high school to work and earn money before making any higher education decisions. Roughly 20% of Gen Z’s approaching high school graduation are considering alternatives to higher education completely, such as entering the workforce or attending trade school.

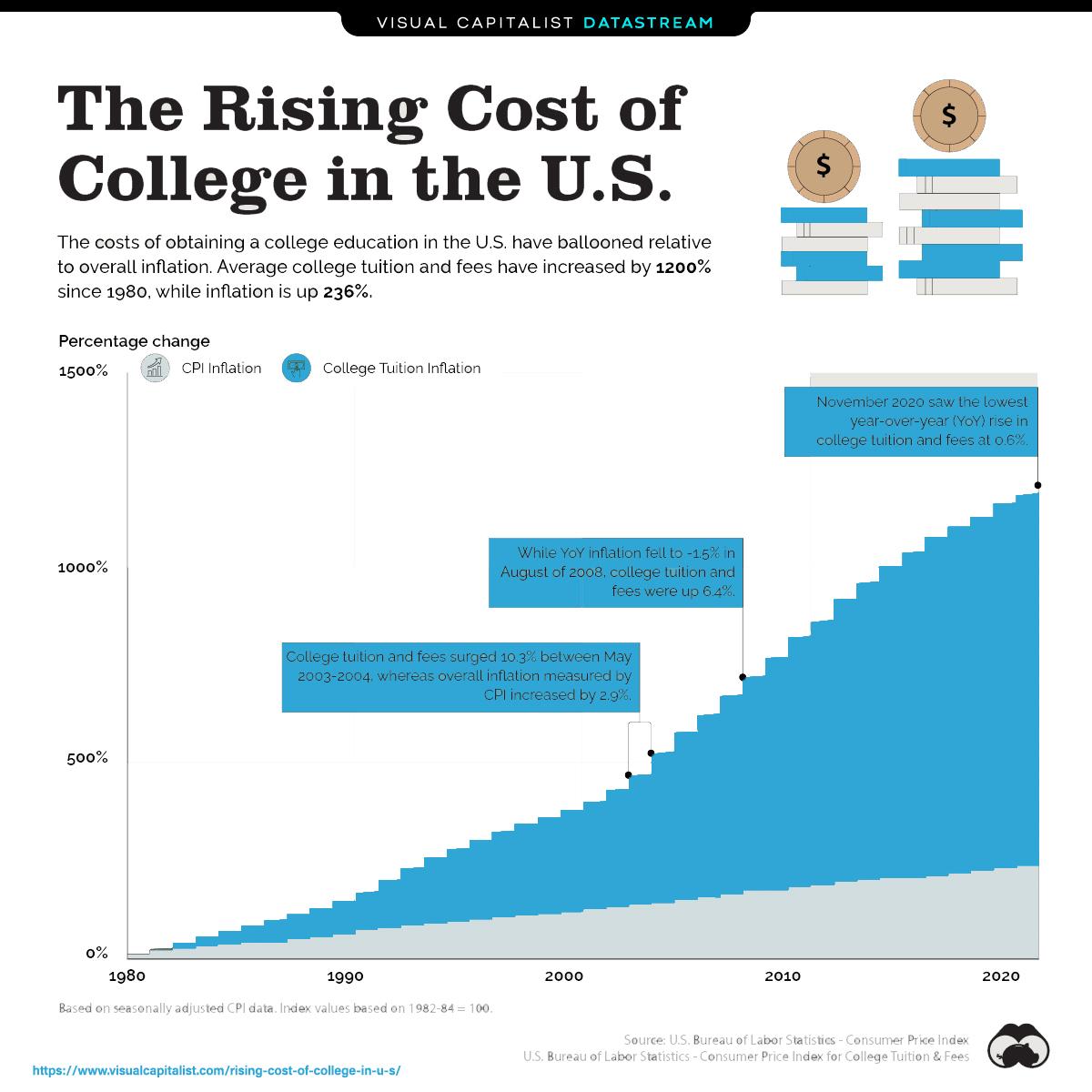

The cost of college has risen by 1200% since 1980, and while the institutions themselves aren’t going anywhere, it’s clear the prices are going to continue to climb.

Higher education is always an option later in life, and the young adults of the Gen Z generation are starting to realize that there are other opportunities available beyond college. Whether you are considering a 4-year college, community college, a trade school, entering the workforce, or building something of your own, the first foray into adulthood will require an investment – and the decision should be treated as such. Explore the cost-benefit analysis before diving into a 4-year commitment, and research alternative options to find what’s best for you.

The NEST Financial team is passionate about helping others find their passion. Whether you are saving saving for a 4-year school or exploring a less-traveled path, a financial plan can help you proceed with confidence. Reach out at info@nestfinancial.net to schedule an initial consultation – that email goes right to the partners’ inboxes!

Find us on:

LinkedIn Facebook Yelp Twitter

DISCLAIMER: We are legally obligated to remind you that the information and opinions shared in this article are for educational purposes only and are not financial planning or investment advice. For guidance about your unique goals, drop us a line at info@nestfinancial.net.