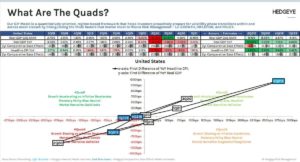

If you’ve been around a while, you’ve heard Sean refer to them time and time again — the Quads. He’s referred to them in his monthly letter and in the NEST Edge webinar. But if you’re not a professional financial advisor (and in some cases, even if you are one), the Quads can be a little difficult to understand.

Like okay, Quad 4 isn’t good, we get it — but why?

At NEST, we find two factors to be most important when forecasting market returns — growth and inflation. We track across multiple durations on a rate of change basis to better understand the big picture. Then we ask the fundamental question: Are growth and inflation heating up or cooling down?

That’s where the Quads come in. In this post, we’re going to get into the different Quads, what each of them means, and how NEST uses this data to actively manage our portfolios.

What are the Quads?

By using the Quads, an idea which comes from Hedgeye’s Growth, Inflation, Policy (GIP) Model, NEST portfolios are able to maximize investment profitability while minimizing risk in any economic environment.

As is implied by the name, there are four Quads, each a combination of growth and inflation, and their either accelerating or slowing rates of change. By keeping an eye on each of these rates of change, we can determine which investment silos are safest and most profitable for that particular time.

Notice that “rates of change” has been bolded multiple times. This is because it is not the rate of either growth or inflation that these quads track. But rather, the rate at which each is changing. We know… complicated.

Essentially, by looking at how slowly or quickly growth and inflation are changing, either positively or negatively, we can anticipate the direction the economy is going to a pretty accurate degree. This allows us to make adjustments to our portfolios in accordance with the best asset class for each environment.

What are the best investments for each quad and why?

The relationship between growth and inflation, and each one’s rate of change, determines the best investments for each Quad. Once we’ve determined to the best of our predictive powers which Quad we’re in, and read the signs for which is coming, we adapt our portfolios to the current economic environment, and plan for what’s down the road.

At NEST, we’re not the kind to just set our portfolios and forget them. We do not subscribe to the 60/40 Model or Modern Portfolio Theory. If the economy is always changing, why would our investments stay the same?

Quad 1 (Goldilocks)

In Quad 1, we see the rate of growth accelerating as the rate of inflation slows. This is called the Goldilocks Quad because despite growth, prices aren’t rising quickly. This makes Quad 1 a great time to invest in equities (stocks), credit (bonds), commodities (wheat, lumber, etc.) and foreign currencies.

Quad 2 (Reflation)

In Quad 2, the rate of change of growth and inflation are both on the rise. Because we’re still seeing growth, but prices are also going up more rapidly, similar to Quad 1, we focus on commodities, equities, credit, and foreign currencies as far as asset classes go.

Quad 3 (Stagflation)

In Quad 3, growth begins to slow but prices are still rising rapidly, creating a wonderful period known as Stagflation. During a Quad 3, we get out of equities for the most part, and focus on gold and commodities. Gold has the unique quality of being used both as a currency and a commodity, and there is some debate over which it should be classified as. For our purposes, gold is being treated as a currency whether gold should be viewed as a currency because it’s more stable than commodities and because people do conduct transactions in gold.

Quad 4 (Deflation)

The dreaded Quad 4. The rate of both growth and inflation are falling. Exactly what you don’t want in a growing, thriving economy. But as we always say, there are opportunities in every economic environment, and Quad 4s are no exception. During Quad 4s, we shift our portfolios to focus on safer, sheltering asset classes, such as gold, bonds, and the USD.

How do we know which Quad we’re currently in?

Similar to the different stages of the business cycle, there is always a delay in the official status of the economy. We have to wait for all the numbers to come in, and sometimes that can take up to a couple months.

In short, we don’t really know what Quad we’re in until after it’s happened.

But, being experienced and knowledgeable observers of the markets and the economy at a macro level, and being professionals who value getting raw data from trustworthy sources, we know how to read the signs. Because of that, our projections are usually on the nose.

That allows us to buy the right thing at the right time, and as we like to say, “get out of the way when the bus is coming.”

Why does NEST use the Quads rather than other systems?

So, what’s the takeaway?

In any quadrant, from Goldilocks down to Deflation, there are smart investments. There’s no such thing as a “bad” market, only bad investment managers. People who ignore the macro level view of the economy, the ones who tell you to ride it out as your stocks drop by 40% because you can recoup the loss in the next upswing, are probably doing you a disservice.

They’re not mitigating loss and maximizing growth. Any growth, however minute, is better than loss.

- They create unnecessary holes from which their clients have to climb out of rather than moving investments into smarter silos.

- They fail to maximize the potential for growth in different asset classes, because they adhere to certain models — literally leaving opportunities for profit untapped.

Think of it like this: if I asked you to drive to Winnipeg, and the only directions I gave you were that it’s north of Ausin, two things would happen:

- You’d wonder why I was sending you to Winnipeg.

- You’d take a lot longer getting there than necessary.

But, if I gave you a smart phone with Winnipeg entered into Google Maps, not only would you make it there, but you’d do it in record time, you speed demon!

The same logic applies to investing. If you just stick to a model and hold on for dear life, eventually you’d reach your financial goals. But without paying close attention to what the economy is doing, and making frequent, well-informed adjustments, you would take a lot of detours, do a lot of backtracking, and maybe even get completely lost at times.

The NEST difference

At NEST, we have backgrounds in both technical trading and in economics. Rare is the investment manager that has that kind of crossover. This gives us – and our method – the unique advantage of being able to get into the minutiae of investing while keeping an eye on and being informed by the big picture.

Most investors aren’t looking at the rates of change of growth and inflation. Most just stick to their models’ ratios without really considering the economy. It’s not their fault — it’s the training they were given.

But we’re happy to say, that isn’t the NEST way.

When you work with us, we save your time and money and help you get to your proverbial Winnipeg as quickly and efficiently as possible. If you’re ready to chat with experienced professionals about the best route to your financial goals why not schedule a no-obligation call with us? We’ve got the expertise and skills to get you where you’re trying to go, even if it isn’t Winnipeg. Let us help you get the Quads on your side. Reach out to us at info@nestfinancial.net.

Find us on:

LinkedIn Facebook Yelp Twitter

DISCLAIMER: We are legally obligated to remind you that the information and opinions shared in this article are for educational purposes only and are not financial planning or investment advice. For guidance about your unique goals, drop us a line at info@nestfinancial.net.

[…] of today, we are now projecting four straight Quad 4’s (slowing growth & inflation). That’s a full calendar year of economic slowdown. […]

[…] NEST’s investment manager, uses the Quad system and reliable, raw, and unbiased data, which he spends hours each day reviewing to constantly tweak […]