And makes claiming ignorance damn near impossible

If you’ve jumped on the cryptocurrency bandwagon, as 27 million people – or about 8% of the U.S. population who currently owns it has, BEWARE.

Everyone’s favorite side of Uncle Sam, the IRS, isn’t messing around with how people claim crypto on their 2021 tax return. So, it’s important to be aware of the potential tax implications this April.

Given the IRS’s focus on crypto in recent years, it’s more likely than ever that filers will face scrutiny if they don’t properly report their crypto holdings. With the relative newness of crypto, it might have been easy to play (or actually be) ignorant in the past.

But no more.

The IRS is making it basically impossible to overlook the fact that you have to claim crypto.

It wasn’t until 2019 that the IRS first started asking a crypto question. The double-lined yes-or-no question was tucked at the top of the Additional Income and Adjustments to Income page. Easily skimmed over.

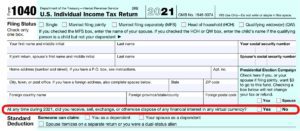

But for 2021, the IRS has wised up, rewording the question and relocating it to a very visible spot — just under your name and address on the front page of the 1040 tax form.

So, the “I didn’t know I had to claim crypto” ignorance defense — not gonna fly.

Here’s what it looks like:

The answer is simple — either you received, sold, sent, or bought crypto, or you didn’t. Answer dishonestly at your own peril.

While it’s true that the IRS only audits less than 1% of tax returns each year, if you happen to be part of that unlucky 1%, you risk higher penalties if you’ve been purposely untruthful. And as we mentioned, kinda hard to claim ignorance when it’s the first question after your name and address.

So, as you prepare to file 2021’s taxes, here are a few things to keep in mind about crypto and c.y.a.

Cryptos aren’t actually currencies

Although “currency” is part of the name, in 2014 the IRS classified them as property, not currencies. As such, the “general tax principles applicable to property transactions apply to transactions using virtual currency,” according to the IRS’s website.

So, whenever you sell or exchange the crypto, that’s when a taxable transaction happens. And because virtual currencies are considered property by the IRS, if you hold them in a taxable account (i.e., not IRAs), they’ll be taxed as capital gains. In essence, you’ll be taxed on how much your crypto investments gained or lost value for the year.

Crossing your fingers and hoping the IRS just won’t pay attention to cryptos?

You might need some extra hands. Last year the IRS took two crypto exchanges to court; they wanted records for any customers that owned over $20,000 in crypto between 2016 and 2020.

Wouldn’t you know it — they won.

The Taxes Get Tricky

Since cryptos are usually purchased and traded as investments, they’re not used for transactions as often. But then, sometimes they are. This is where things can get tricky for those who use cryptos for transactions. The transaction generates a taxable sale — which must be reported to the IRS.

So, if you’re selling crypto for goods or services, you need to calculate the fair market value of what you received in return and include that amount as income on your tax.

Need an example? Frederick purchases an RV with $50,000 worth of crypto that he only spent $25,000 on. That $25k difference is taxable. Just like if he’d bought the RV with Google shares that had grown from $25k to $50k, Frederick will have to report that taxable gain to the IRS.

New year, new rules

Contrary to what you might believe, even the IRS doesn’t have all the answers. Considering that crypto hasn’t yet reached its 10th birthday, they’re still creating and adjusting the landscape for taxes and cryptocurrencies.

Every year, it seems. For example, in 2019 the IRS issued guidance for how you should treat cryptos if they undergo a reorganization that changes the network protocol of coins. The following year, the Financial Crimes Enforcement Network was considering a requirement that people holding cryptos offshore report their holdings, though this hasn’t been adopted, yet.

Crypto evolves and its value fluctuates very quickly. It’s no surprise that the rules and regulations surrounding it are changing with equal speed. But while it can be difficult to keep track, ignorantia juris non-excusat — ignorance of the law doesn’t excuse you from it.

If you’re finding it challenging to stay on top of all the changes, connect with our financial planning professionals by scheduling a no-obligation call. At NEST Financial, we can help make crypto not quite so cryptic.

Find us on:

LinkedIn Facebook Yelp Twitter

DISCLAIMER: We are legally obligated to remind you that the information and opinions shared in this article are for educational purposes only and are not financial planning or investment advice. For guidance about your unique goals, drop us a line at info@nestfinancial.net