Hello, fellow business owners! If you’re looking for information on business budgeting, you’ve come to the right place. Navigating it can be as challenging as Austin’s South by Southwest traffic. But fear not, it doesn’t have to be overwhelming. By using the right approach and following helpful tips, your business budget can guide your financial success.

Budgeting may seem intimidating at first, but it doesn’t have to be. In fact, think of a business budget as your trusty GPS. It can steer you towards financial prosperity on your entrepreneurial journey.

When starting your own organization, money demands are constant. As an independent company owner, it’s important to establish your own financial goals – just like setting a destination on a road trip. To assist with personal finance and business growth, here are some tips to develop and manage a budget:

- Clear Financial Objectives: Start by setting clear financial goals for your business. These will be like milestones along your journey. They’ll help you stay focused and motivated.

- Consider All Income and Expenses: Think of income as the fuel that powers your business engine. Expenses are the necessary pit stops along the way. Consider everything from sales revenue to operating costs when creating your budget.

- Prioritize Your Spending: Just like choosing which attractions to visit during a trip, prioritize spending based on what is essential for your business. Those things that directly contribute to its growth and success.

- Regularly Review and Adjust: Remember that even the best-planned trips may require detours or last-minute changes due to unexpected road closures. Or exciting discoveries along the way. Similarly, regularly review and adjust your budget as needed based on new information or changing circumstances.

- Track Progress and Make Changes: Keep an eye on how well you’re progressing towards your financial goals. If you find that certain expenses are draining your resources without providing significant returns, don’t hesitate to make necessary changes to keep your business on track.

Remember, with proper budgeting techniques in place, you can confidently navigate the financial landscape of running a successful business – much like a skilled driver maneuvering through Austin’s busy streets during South by Southwest. So buckle up and let your well-crafted budget be your guiding map towards entrepreneurial triumph!

Understanding the Importance of a Business Budget – Through the story tale of Jane

Sometimes, it’s easier to relate to topics in story form to keep it fun. We at Nest like to have fun and keep things light. So here goes..

Once upon a time, in the vibrant city of Austin, there lived a determined small business owner named Jane. She was the creative force behind a flourishing jewelry business, and she had big dreams of achieving financial success.

But little did Jane know, there was an evil villain lurking in the shadows of life’s challenges. This villain, known as Survival, constantly tested Jane’s resilience and determination to thrive amidst the chaos of entrepreneurship.

The Trusted Weapon

Undeterred by this formidable adversary, Jane saw her business budget as her trusted weapon. It was a map carefully crafted to navigate through the treacherous terrain of financial uncertainties. With each decision guided by her budget, she deftly avoided spending excess money while making informed choices that propelled her towards success.

Jane understood that her budget not only checked the financial health of her business but also served as a shield against Survival’s tricks. Regularly reviewing and updating her budget became second nature to Jane. She meticulously analyzed past performance and forecasted future revenue to stay one step ahead of Survival’s malevolent plans.

Armed with insights from her budgeting efforts and fortified with resilience, Jane adapted swiftly to changes in the market landscape. She allocated resources wisely and adjusted her strategies accordingly, all while staying true to her passion for creating exquisite jewelry.

Survival of the Fittest

Survival continued to test Jane’s mettle throughout her journey, but armed with her well-crafted budget and unwavering determination, she emerged victorious time after time. Her jewelry business flourished under the weight of adversity, leaving Survival powerless against Jane’s unwavering spirit.

And so it was that Jane overcame every obstacle thrown in her path by Survival. Her small jewelry business bloomed into a shining example of triumph over adversity—a testament to what could be achieved when armed with a powerful tool like a well-maintained budget.

In conclusion, let us celebrate the tale of Jane—the courageous small business owner who conquered all odds through creativity, determination, and the invaluable guidance of her budget. Together, they proved that even in the face of an evil villain like Survival, success could be achieved, and dreams could become reality.

Tip 1: Understand the Basics

Successful businesses have a common trait: they understand their business budget. This understanding begins with the basics. Firstly, a business budget is a financial plan for a specific period, typically a year. It provides an overview by outlining estimated revenue and expenses. This blueprint serves as a crucial tool for success by forecasting your financial health.

Think of a business budget as a bridge between your business plan and reality. It acts as a roadmap that measures your performance against your goals. By ensuring every dollar drives growth, it prevents wasted expenditure. Moreover, a proper budget enables you to make informed decisions and manage resources effectively.

Similar to knowing driving basics before embarking on a road trip, understanding a budget is vital for successful budgeting. It helps keep your finances in check and prevents overspending. Grasping the basics of a business budget is the initial step towards successful budgeting.

The main purposes of a good budget are preventing overspending and guiding decisions. A well-designed budget provides clear visibility into revenue and expenses, which aids in making informed decisions and enhances financial health.

Tip 2: Plan for Unexpected Costs

Like an Austinite prepared for sudden rain showers, a savvy business owner anticipates unforeseen expenses. Repairs, spontaneous marketing needs, or growth opportunities can catch a business off guard. Even the most well-planned budget can be derailed by surprise costs. However, having an emergency fund acts as a financial buffer, allowing you to handle these expenses without straining your cash flow. Save 3-6 months’ worth of expenses as insurance against financial shocks. Unforeseen costs are a reality in small businesses but can be managed with an emergency fund. It provides peace of mind and allows you to navigate unexpected situations confidently. With an emergency fund in place, you won’t have to scramble for funds or resort to debt when faced with sudden expenses. Just like carrying an umbrella in Austin’s unpredictable weather, having an emergency fund is essential for every business owner. It ensures preparedness and financial stability through challenges.

Tip 3: Keep an Eye on Cash Flow

Cash flow is important for your business, just like the Colorado River is crucial to Austin. A strong budget helps you track and control cash flow effectively. Every dollar counts, from payments received from customers to expenses such as rent and employee salaries. A master budget keeps a close eye on cash flow and ensures that there are enough funds available for business expenditures. By having an appropriate budget in place, you can smoothly manage your operations and handle cash flow efficiently. This involves understanding the rhythm of your business and covering both fixed and variable costs.

In summary, managing cash flow is essential for any business. Having a well-defined budget allows you to keep track of your financial transactions, ensuring that all income and expenses are accounted for. It enables you to allocate sufficient funds for various aspects of your business and make informed decisions regarding investments or cost-cutting measures. By maintaining a healthy cash flow, you can ensure the stability and growth of your business in the long run while avoiding any potential financial challenges along the way.

Overall, by carefully managing your cash flow through a robust budgeting process, you can maintain control over your finances and set yourself up for success in the competitive business landscape.

Tip 4: Differentiate between Fixed and Variable Costs

Similar to predicting traffic on I-35 to plan your day, understanding fixed and variable costs is crucial for effective budgeting. Fixed costs, like rent and salaries, remain constant regardless of business activities. However, variable costs can change unpredictably, similar to the ever-changing weather in Austin. These fluctuating expenses may include raw materials or seasonal workers. By clearly distinguishing between fixed and variable costs, you can forecast your budget more accurately and manage your business finances better.

Knowing your fixed and variable costs is vital for effective budgeting. It allows you to make more precise predictions and improve financial management. By identifying these two types of costs, you gain valuable insights into your business’s financial stability and can make informed decisions about resource allocation.

Moreover, recognizing the distinction between fixed and variable costs helps identify areas for cost reduction or improvement. Understanding which expenses are fixed versus subject to change enables analysis of opportunities for optimizing cost-efficiency.

In summary, being aware of both fixed and variable costs is essential in effective budgeting as it provides the necessary information for accurate predictions, improved financial management, and identification of areas for optimization within business operations. Just as predicting Austin’s unpredictable weather aids residents in planning activities, understanding fixed and variable costs aids businesses in successful financial planning.

By differentiating between fixed costs that remain constant regardless of production levels or sales volume and variable costs that fluctuate with changes in production or sales, businesses can allocate their resources more efficiently. This knowledge allows them to prioritize cost reduction efforts on areas where the greatest impact can be made.

Furthermore, understanding the composition of fixed and variable costs facilitates better decision-making regarding pricing strategies, product mix optimization, and overall financial stability. It empowers businesses to make informed choices that align with their goals while driving profitability and sustainability.

Tip 5: Factor in Employee Salaries

Consider your employees as the vibrant melodies that embody the essence of Austin’s spirit. They are among the most invaluable assets of your business, and their remuneration constitutes a significant portion of your expenditures. When planning your small business’s budget, it is crucial to accurately allocate funds for salaries, ensuring equitable compensation for your employees. This practice not only enhances their productivity but also fosters loyalty towards your organization. Additionally, it is essential to account for supplementary expenses such as payroll taxes, benefits, and potential overtime when estimating salary budgets.

Tip 6: Set Clear Financial Goals

Setting clear financial goals is crucial for effective business budget planning. By aiming to increase revenue, decrease expenses, or expand your business, you can provide direction to your budgeting process and easily monitor progress. These goals serve as a compass for strategic resource allocation and informed decision-making. Moreover, they help track progress over time and assess whether adjustments are needed. Just as Austin had a goal in becoming the Live Music Capital of the World, clear financial goals are vital in budget planning. They focus efforts, allocate resources strategically, and enable accurate progress measurement. Aim for increased revenue, reduced costs, or business growth while tracking advancements along the way.

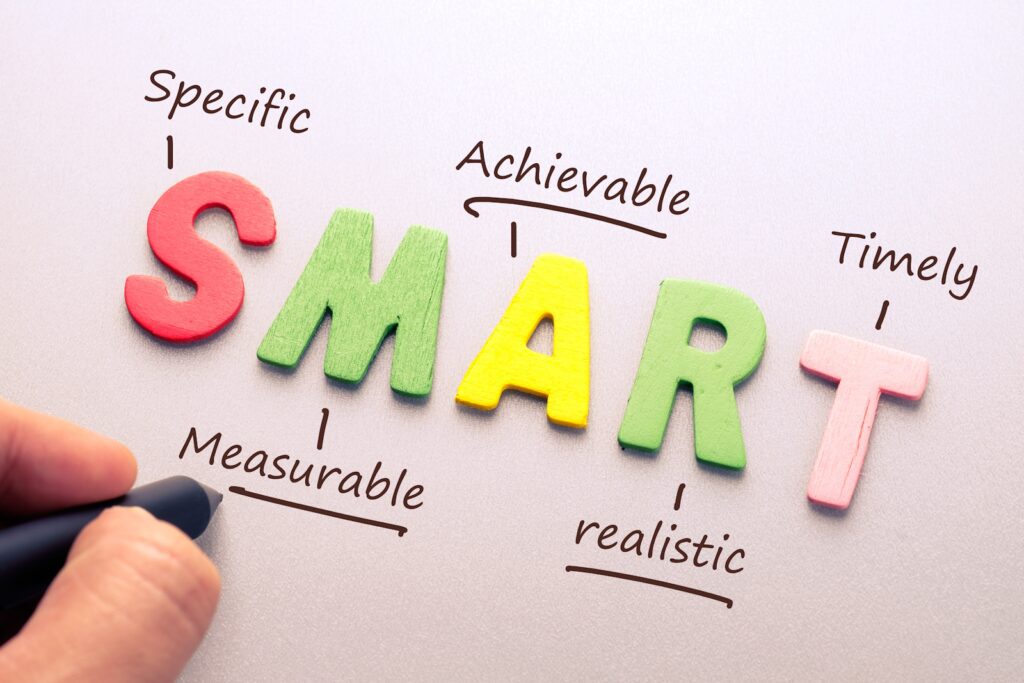

These goals should be SMART:

The Specific goals should align with overall objectives. Additionally, they must be measurable, achievable, relevant, and time-bound.

Regularly reviewing and adjusting goals is essential to reflect evolving business needs. Setting clear financial goals is like setting a GPS for your business; it provides guidance for budget planning.

Tip 7: Use the Right Tools

Let’s face it, business owners are a bit like the superheroes of the real world. But even superheroes have their tools. Tools like accounting software can simplify the budgeting process, saving you time, reducing errors, and offering valuable insights into your business finances.

There are many tools that can simplify the budgeting process. Using these tools can save you time, reduce errors, and provide valuable insights into your business finances.

FAQs

Q: What’s the value of a budget in business?

A: A budget in business is a valuable tool as it provides a clear plan for managing financial resources. It helps make informed decisions, predicts future revenue and expenses, and allows for comparison against financial targets to assess performance.

Q: Why is a budget crucial?

A: A budget is crucial because it helps you plan ahead, manage your cash flow, and make strategic decisions on resource allocation. Without a budget, managing your business finances effectively may be challenging.

Q: What is the 25% rule budget?

A: The 25% rule says that your housing costs should be no more than 25% of your total income. This includes things like mortgage payments, property taxes, insurance, and maintenance. If you spend more than 25%, you might not have enough money for other things.

Q: What are the 3 key parts of budgeting?

A: The three key parts of effective budgeting are income, expenses, and goals. Understanding your income allows for wise resource allocation, tracking expenses aids in cash flow control, and setting goals gives your budget purpose.

Q: What’s most important for successful budgeting?

A: A budget in business is a valuable tool as it provides a clear plan for managing financial resources. It helps make informed decisions, predicts future revenue and expenses, and allows for comparison against financial targets to assess performance.

Q: What happens if the budget isn’t met?

A: Not meeting your budget can lead to cash flow issues, failing to meet financial obligations, and ultimately, business failure. A budget guides your business by predicting revenue, managing expenses, and avoiding financial problems.

Q: What are the two main purposes of a business budget?

A: The two main purposes of a business budget are planning and controlling resources and cash flow. A budget aids in planning your business activities and managing your cash flow, ensuring your business stays financially healthy.

Q: What should a business budget include?

A: A business budget should include estimates of income and expenses, cash flow forecasts, capital investment plans, and financial goals. A budget should also account for unforeseen events, such as unexpected expenses or market changes that could affect your business. Moreover, a budget should be reviewed regularly to ensure it is current and accurate.

Conclusion: Budgeting for Business Success

Like keeping Austin unique, keeping your small business profitable requires effort, planning, and a good budget. To set clear goals and manage your finances well, make a rough budget, review it regularly, and revise as needed. This helps you plan for the future and make informed decisions that drive your business forward. If you need assistance with budget planning, Nest Financial is here for you. With over 40+ years of experience, we provide guidance and support to help you control your business finances. Connect with our financial planning professionals to schedule a call – no obligation required.

This article is brought to you by the wizard behind the scenes with 23 years of experience, Dan Dillard, Of course with his workshop of helpers including some handy hi-tech sourcing.

If you’re finding it challenging to stay on top of all the changes, connect with our financial planning professionals by scheduling a no-obligation call. At NEST Financial, we can help make crypto not quite so cryptic.

Find us on:

LinkedIn Facebook Yelp Twitter

If you like reading more entrepreneurial stories In Austin check out Dan’s other company foundingAustin. If you are into podcasts click here.

DISCLAIMER: We are legally obligated to remind you that the information and opinions shared in this article are for educational purposes only. These are not financial planning or investment advice. For guidance about your unique goals, drop us a line at info@nestfinancial.net

[…] remember, if you need more help with your business budget planning or personal budgeting, we at Nest Financial are always here for you. With over 40+ years of […]

[…] into reality. Common practices of self-made millionaires include consistent saving and investing, goal-oriented planning, continuous learning, strategic networking, and risk […]