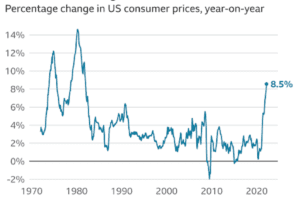

Inflation. You can’t look at the news without seeing the word these days. And with rates at a 40 year high of 8.6 percent, it’s no wonder.

In fact, in 2022 prices saw the largest single year increase since 1979, with food and energy hitting especially hard.

When people encounter the word “inflation,” they might not be entirely clear on what it means. There’s just a sense that in general, it’s not good, and that because of it you can’t get that loaf of bread for $.20 like your grandparents did.

But what exactly is inflation? What causes it to spike? And is it always a bad thing?

What is inflation?

Inflation is simply the increase in the average price of goods and services.

In short, a dollar will only go a fraction as far as it did. As prices go up, the value of currency goes down. They have what fancy people call an “inverse relationship.” One goes up, the other comes down. Like a seesaw.

When the price of groceries goes up 15%, that line in your budget decreases in value. The $1,000 you’ve set aside a month just isn’t going to buy you as many loaves of bread as it once did.

When housing spikes, the money you’ve been saving to put a down payment on a home isn’t going to get you what it would before.

And when gas prices soar, it doesn’t just affect your summer road trip — it affects everything that relies on gas. Which is, well, pretty much everything.

Credit: US Bureau of Labor Statistics

The economic cycle

This can happen when everything is going well. Business is booming, unemployment is low, pay is high. When people have more disposable income, there’s higher demand for goods and services in general. So, prices go up.

But when prices go up too much, people start to buy less. Demand decreases, so production decreases. When production decreases, fewer employees are needed.

Thus begins an economic downturn. This is a natural part of the economic cycle.

Inflation spikes

Inflation itself is an ever-present feature of our currency, averaging a long-term rate of 3.2% per year. But at times, the whole process can get a bit out of hand.

Oftentimes this comes about when the Fed steps in. In order to curtail inflation, they raise interest rates. It’s an effective strategy — sometimes a little too effective. When this happens, it can lead to an over-contraction, otherwise known as a recession.

During a recession, the economy suffers — unemployment rises, wages stagnate, production slows. And because people have less disposable income, companies’ profits drop. So, what do they do? Lay people off and raise prices, further exacerbating the problem.

The good news is that eventually the rate of inflation will slow. But in the meantime, your money and investments will have to work that much harder to keep up with inflation.

What drives inflation?

To a smaller degree, supply and demand can drive inflation, but we have to be aware that a price increase in one sector doesn’t necessarily equal inflation.

However, when there’s economy-wide increases in demand without the means to meet it, that spells inflation.

And there are certain sectors that others depend on to such a degree that a surge in their prices can have a domino effect — namely energy.

While sometimes an increase in energy prices can result from increased demand and decreased supply, it’s generally caused by input prices going up. The price of oil, the price of coal, the price of metals, the price of grain. You get the picture.

When the price of a single or several inputs increase, the cost to produce the goods increases. And the producers pass that on to the consumer. So when, for example, war causes an oil shortage, or drought causes a grain shortage, or a pandemic causes an everything shortage, the price goes up and customers pick up the tab.

Production ground to a halt with Covid in 2020. In 2021, the demand for goods skyrocketed. But the thing about rockets is that they eventually fall back to earth. Demand for scarce inputs soared, taking the rate of inflation along with it.

And now here we are.

What can you do?

Personal Finance

When inflation is high, most people that live on a budget have three choices when it comes to their personal finances and lifestyle:

- Spend less

- Use your savings

- Go into debt

Something’s got to give, and we’ve put them in the ideal order.

The best thing you can do is look at your budget and see where you can reduce your spending. If every dollar gets you 90% as much as if used to, your budget just won’t hold. Unless your pay increases to match inflation, your personal spending has to come down.

Your second option is to dip into your savings. But as we’ve mentioned before, if the economy goes into recession, your budget should tighten its belt as well. It’s not a time to deplete your nest egg, especially if you work in a sector that’s likely to downsize.

Going into debt should be a last resort. Why pay money to spend money?

Investments

When it comes to your investments, commodities are generally the way to go during a time of high inflation. Remember those inputs we mentioned whose rising prices drive inflation? Investing in those can actually help your portfolio battle rising prices. That rising tide can lift your boat — as long as you have one.

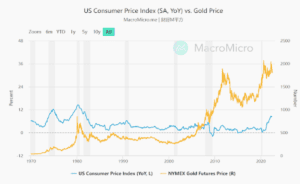

And while popular opinion holds that gold is an inflation hedge, at NEST we disagree. We’re not saying that gold is a bad investment. We’re saying that it has a low correlation to inflation.

Sometimes when inflation is high, so is the price of gold. And sometimes it’s not. In order for gold to be a hedge against inflation, they would have to be strongly correlated. That is, when inflation went up, so would the price of gold. But that’s just not the case, at least not often enough for it to be meaningful.

Credit: Graph by MacroMicro 2022

If you have more questions about inflation and how it affects your personal finances and investments, schedule a no-obligation call with us. We’ve been riding the ups and downs of the economic cycle for nearly 30 years, and we’d love to help you thrive in any economic environment. You can also reach out to us at info@nestfinancial.net.

Find us on:

LinkedIn Facebook Yelp Twitter

DISCLAIMER: We are legally obligated to remind you that the information and opinions shared in this article are for educational purposes only and are not financial planning or investment advice. For guidance about your unique goals, drop us a line at info@nestfinancial.net.