The NEST Edge

The NEST Edge is a monthly webinar hosted by NEST Financial Founder, Dan Dillard, with CIO and Partner, Sean McDougle. Together they discuss what the markets and economy are currently doing and add their outlook on portfolio management. You can watch this month’s NEST Edge on our YouTube channel.

April 2021

In this NEST Edge segment, Senior Partner Dan Dillard and Chief Portfolio Manager Sean McDougle discuss what Archegos Captial is, why that name is in the headlines and what all the media kerfuffle is about, and how Archegos’ behavior has affected the markets.

Highlights include:

- How the action of one person affect the markets so drastically

- How over borrowing still happens today

- Rules about over borrowing

- Why NEST got out of China

- NEST’s leverage process, and how and why we deleverage

A Letter from Sean

Recent front-page news about Archegos Capital and Bill Hwang has Wall Street looking around afraid and praying this is not the first domino or the tip of the iceberg. Admittedly, this does have echoes of 2008 when there were whispers of systematic issues which is the biggest reason this has the Old Wall a little rattled.

There are two big things I want to point out right from the start. The first is that hedge funds fail all the time. Goldman Sachs Prime Brokerage came out with a report saying that as of 3/12/21, 84% of hedge funds that trade with them are down 3-5% so far in 2021.

The second point is that Archegos Capital was not a hedge fund. Archegos is a family office, which is a fancy pants word for a firm that manages the money of one person or family. That person happens to be Bill Hwang, who was also the portfolio manager. So no one is more upset about this than Bill because he just lost $10+ billion of his own money.

Bill Hwang himself has an interesting background. He got his start with Tiger Management & the legendary manager, Julian Robertson, in 2001, and returned 40%+ every year until 2008. Those who got their start with Tiger Management are often known as “Tiger Cubs” and are generally highly respected.

Things for sure went a little sideways in 2012 when Bill pleaded guilty for insider trading, but that’s not necessarily a death sentence and unfortunately, isn’t abnormal at the highest levels of this game. In 2013, Bill founded Archegos Capital and started with his own money.

Where this story does get more sideways is that he was super focused on certain positions where he didn’t actually own the security so he was able to sidestep some regulations in place AND he was using leverage. I like to describe using leverage like going to a casino.

Let’s say John has $1,000 in his pocket and he asks the casino to loan him an additional $10,000 so he has the opportunity to play bigger and more games, so he can win more if he wins. The proverbial fan will start if he loses because no matter what happens he owes that $10k plus interest. No one cares if you lose your own $1k but the casino definitely cares if you lose their money. You can replace the casino with banks in this very real situation that Bill Hwang finds himself in.

The problem with Bill is that his positions had dropped so far in value that the banks needed to see some actual money put back (margin call), but now he owes so much money it is impossible for him to repay it. The banks will most likely mark it down as a loss.

On the surface, Bill and these banks (Goldman Sachs, Credit Suisse, etc.) are out billions of dollars – who cares, right? Well, we all care at some level because if this is just the start, it can unravel very fast, as we saw in 2008. Bill had a lot of focus on China and specifically their tech sector, and Wall Street has a habit of crowding into the same positions.

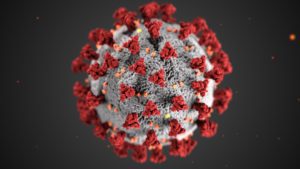

China is roughly 6 months ahead of us in its economic and COVID cycle, so the fear is the question of how many other firms in the US and Europe are also extremely overconcentrated and overleveraged. This could be revealed when we go into our own economic slowdown like what China is dealing with right now. Do not for a second think that the economic impacts of COVID-19 are done. Remember, we had a debt problem coming into 2020 and we got through it by adding more debt.

I’ll be the first one to admit that Bill Hwang’s resume is scary impressive and the guy is one of the smartest in my field. I don’t know what exactly went wrong, but being this heavy and focused in China was a screamingly bad idea months ago which is why we got totally out. There is still a lot about these trades we don’t know, or even how much leverage he was using. We do use leverage but only for our most aggressive models, no more than three times, and never for long.

People get in trouble when they don’t de-leverage when their positions go up. In addition to sticking to our data-based investment process, we avoid emotion and don’t get greedy. Hogs get fat and pigs get slaughtered.

Sean McDougle, CFP®

Chief Investment Officer & Partner, NEST Financial

We are here to inform you with non-bias investment education to help families and business owners and leaders reach their goals. Disclaimer: Please note that the content provided in the webinars and recordings is not investment advice. For guidance on your unique goals, feel free to contact us to schedule an appointment with us by email info@nestfinancial.net.

Find us on:

[…] two countries have improved the relationship. But, tension still exists, especially over Taiwan. Uncertainty about China’s economy also limits […]

[…] moment when you first wake up and immediately regret all the decisions of the previous day. The “alarm” has gone off, we (the US economy) have been on a rager, living on Coors Light and shots of Tully […]