If “new normal” was the phrase of 2020, “new variant” is the phrase of 2021. As we have yet to establish herd immunity or get vaccines to every country on the globe, variants of the COVID-19 virus have emerged throughout the year. Some of them have gained more public attention than others, and currently the “Omicron” variant is in the spotlight.

While most variants seem to be more contagious, their symptoms are less intense and life-threatening. Coupled with the fact that we are more equipped than before to treat COVID-19, and that many people are vaccinated which further palliates the symptoms, the variants as of yet have not required full-blown lockdowns reminiscent of March 2020 (knock on wood).

But, as you surely know by now, we are financial professionals – not doctors. While we are not qualified to discuss virus variants at length, we can, as financial planning and investment management experts, discuss the COVID-19 variants from the perspective of how they have affected the world of finance.

The Omicron Variant

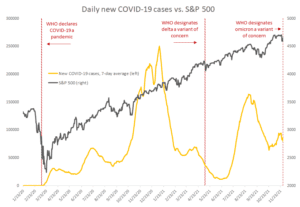

The Omicron variant is the most recent example we can look at. Omicron was announced in late November, and investors immediately wondered what impact the ensuing travel restrictions, mask mandates, and lockdown fears might have on the markets. There has been a spike in market volatility since that time, with the S&P 500 recording gains and losses of more than 1% over the six days following the omicron developments. The volatility index also spiked on November 26th, right after news of the variant hit mainstream media headlines. The VIX went up from about 18 to almost 29, and has hovered around the mid-20s since.

Volatility is likely to remain high, which is such an obvious statement that we might as well have told you that water will be wet and the sky will be blue. But how volatile, exactly, will things get?

A glimpse at the S&P 500 performance during the beginning of the pandemic in 2020 might give us some hints as to what effect Omicron and the inevitable emergence of new variants might have on the stock market. But a reminder – past performance does not have any bearing on future results, as every investor worth their salt knows. But it does seem that there is an increase in investor anxiety in the short-term whenever a new variant is discovered and announced.

Chicken or the Egg

Beyond investor fears, Omicron and the rest of the COVID-19 variants have affected the markets in other ways, although it becomes a bit “chicken or the egg” as we consider these effects.

When a new variant emerges, countries mandate lockdowns and travel restrictions and states or counties enforce new laws, such as requiring workplaces to enforce vaccination for their employees. These mandates and restrictions impact the supply chain, which is still recovering from 2020, and exacerbate other lingering effects of the major lockdown such as labor shortages.

While Omicron is dominating headlines, it’s easy to forget that there are other reasons why investors may ease their collective foot off the gas a bit. Among these reasons is ongoing concern that stocks in general are valued too high right now, and we may be in the late stages of an equities bubble that will pop any day now. Throw the year of rising inflation and the Fed’s increased urgency to start the tapering process,which will spike interest rates, into the mix – and you’ve got a lot of hits to the economy that will be reflected in the stock market, independent of investor fears about Omicron or Delta or whatever the next one is called. These disruptions and general investor biases affect the markets independent of concerns about variants, but they also compound them, creating a snowball effect. It’s no wonder that the VIX may be higher going into December.

While Omicron might be the current show stopper, there are a lot of economic factors at play that contextualize a volatile stock market in this final month of 2021. Join Sean and Gloria NEXT Wednesday, 12/15/21 on the NEST Edge webinar to discuss this turbulent state of the markets and learn how NEST’s outlook will shift going into 2022.

In the meantime, enjoy the holiday season and remember that the markets are always going to shift and will often exhibit some irrational behavior, regardless of what’s going on in the news. If you’d rather go holiday shopping and leave investment strategy to the professionals, reach out at info@nestfinancial.net and join the other Austin families and individuals who want a professional to manage their investments. Join us on the Edge webinar, read about our portfolios, and schedule a no-obligation consultation to learn how we can give you the freedom and confidence that comes with knowing your money is working as hard as you are.

Find us on:

LinkedIn Facebook Yelp Twitter

DISCLAIMER: We are legally obligated to remind you that the information and opinions shared in this article are for educational purposes only and are not financial planning or investment advice. For guidance about your unique goals, drop us a line at info@nestfinancial.net

[…] pandemic has caused a slew of economic impacts, which continue to evolve and aggregate with each new variant. The “Great Resignation,” or labor shortage, is one recent economic trend that folks are […]