Why use an investing strategy that’s based on a horse race?

“Sell in May and go away” is one of the oldest stock market strategies, but you might want to think twice about using it yourself. To tell you why we need to first look at the history behind the saying.

The Strategy

“Sell in May and go away” is an old Wall Street adage that means you should sell your stocks in May to avoid the decline in the market that happens seasonally, and then buy stocks again around Halloween. This is because the period of time from November to April shows much stronger market growth than May to October does.

Despite its popularity on Wall Street, the advice wasn’t coined there. Its origins actually lie in the London Financial District. The original saying is actually, “sell in May and go away, come back on St. Leger’s Day.” But what is St. Leger’s Day? Well, it’s a horse race. That’s right, this wildly popular piece of advice is based on a horse race.

St. Leger Stakes is a horse race in Great Britain that was established in 1776. It is one of the oldest races in Britain and takes place every year in September on St. Leger’s Day. Back in the old days, in London traders would sell their shares and buy back into the market after the St. Leger race. It was based on the principle discussed above that the market is stronger from November to April, so traders that followed this strategy were only invested in the market for 6 months of the year.

The Historical Statistics

For the past 75 years, stocks have actually done better during the period of winter to early spring. Since 1945, the S&P 500 has gained a cumulative 6-month average of almost 2% from May to October on a price return basis as stated by the Stock Trader’s Almanac. From November to April, the S&P 500 gained on average 6.7%.

Maybe the British and horses had it right because the S&P 500 only lost money in 13% of the periods of November to April since 1945 and 33% in the May to October periods.

The Recent Statistics

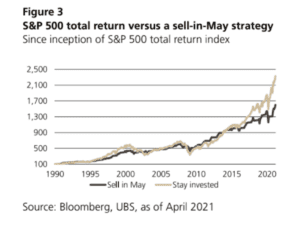

So for the past 75 years that “strategy” seems to have worked. Seeing the evidence might make you want to partake as well, but before you start selling, let’s look at a scenario in the short term. The chart shows the difference between staying in the market and using the “sell in May” strategy over the past 30 years.

“It’s Different This Time”

One of the most dangerous phrases in life and investing is “it’s different this time.” If someone says this while in a conversation about investing, the markets, or anything that’s finance-related, you should very quickly leave.

- Last year: the S&P 500 gained approximately 27% from November 1, 2020, to April 30, 2020. If you sold in May 2020 and bought back in on November 1, 2020, then you missed the S&P 500 returning 13.97%.

- The year before that: The S&P 500 lost around 5% from November 1, 2019, to April 30, 2020.

- The year before that: If you sold in May and bought back in on November 1, 2018, then you missed the S&P 500 returning 2.6% as it gained 8% from November 1, 2018, to April 30, 2019.

We could go on and on, but you get the picture. It’s never different, especially considering what happened in 2020 and 2021.

What Else is There to Worry About

Despite the proof that this “strategy” hasn’t worked in a long time, there are other things you need to worry about with it.

- You need to take into account that with a strategy based on averages, any year could show an extreme high or an extreme low. It’s a wave that a buy-and-hold investor could ride out.

- You lose their short-term gains to taxes due to their gains being taxed at your regular rate.

- You face additional transaction costs because of selling stocks and mutual funds, then buying stocks and mutual funds.

Working with You Advisor

The key to investing is to follow wise, proven strategies. It’s not really a great idea to follow “strategies” that are based on statistics that aren’t explained by actual market trends or economic analysis.

While no investment strategy is foolproof, your best strategy should focus on the traditional factors of the assessment of business cycles, changing economic conditions, and market news.

Your financial advisors know these strategies and are the best resource for info on how to handle your money. At NEST Financial our advisors are here to guide you in planning for your future, no horse races involved. Contact us to set up a no-commitment introductory meeting.

[…] probably heard of “Sell in May and Go Away‘, a piece of archaic investing advice that suggests investors sell their stocks in May and […]