Pumpkin spice lattes are back on the menu, blazing temperatures are finally starting to simmer down, and Spirit Halloweens will be taking over gutted commercial real estate in no time. All signs point to the arrival of fall, which is great if you love cozy flannels and crunchy leaves – but allegedly is not so great for investors. There’s a rumor in the crisp fall air that September is the weakest month for stock market performance, and we thought we should investigate it.

Seasonal Suggestions

You’ve probably heard of “Sell in May and Go Away‘, a piece of archaic investing advice that suggests investors sell their stocks in May and come back around Halloween to buy again. Upon further investigation, however, it’s clear that this is more than an old wive’s tale – this particular adage is based on a horse race that happened in London in the 1700s. If people want to shape their investing strategy around rhyming quips from centuries ago, they’re more than welcome to do that, but at NEST we try to keep things contemporary, so as you can imagine we approach this idea about September with skepticism.

During 2021 the S&P 500 has seen seven months of consistent gains, crossing the Labor Day line with a 20% increase year-to-date. No one can predict the future, but now that we are in September some investors are sweating – not because of the temperatures outside, but because historically, September is the weakest month for the stock market. On average, the S&P has incurred a loss of 0.99% since 1928.

Sometimes called “The September Effect,” this idea that September is the worst month for the stock market is true for worldwide markets, and some analysts think that the negative effect on markets is due to cognitive and emotional biases in which investors respond to the assumption that September will be a bad month, and thus adjust their positions accordingly at the end of the summer.

It’s interesting to note that May, the other month with a negative stock-related reputation, also marks a transition around summer. May transitions us into summer, while September marks the transition out of summer and into fall. In both of these cases, vacations may be bringing investors away from their desks, thus causing them to be less actively engaged in their portfolios during this time.

Whatever the reason for September’s historically negative return rate, it’s safe to say that investors ought not base their strategy on “what happened last time,” even if (or maybe especially if) there’s a myth involved.

Contemporary Data

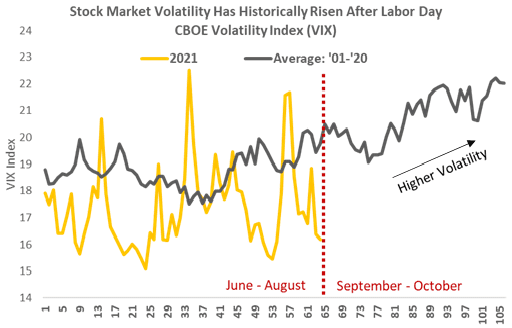

Looking at this year alone, 2021 has already seen higher volatility than average across the last 20 years. Given continuing uncertainty surrounding COVID variants and the Fed’s debates and discussions about tapering (or buying fewer bonds) by the end of the year, it’s likely that this trend will continue. Combine shifting pandemic-related policy with soaring inflation and a labor shortage, there’s more than a few reasons to assume that this volatility remains on the horizon.

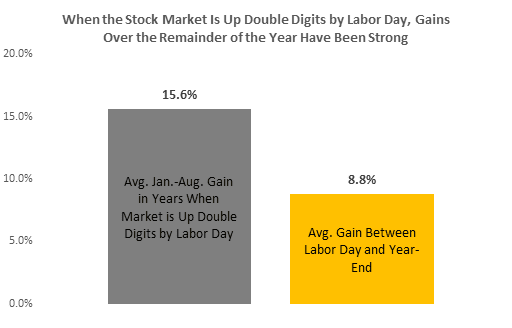

As we mentioned above, the S&P 500 has risen more than 20% through the end of August this year. In the other 8 years since 1991 that the stock market was up significantly by Labor Day, there was an average gain of 8.8% from September to the end of that year.

So despite the “September Effect” myth and historically poor returns during this month, there’s data that points to the possibility that the last quarter of 2021 will continue this trend and see similar returns.

Either way, it bears repeating: basing your investment strategy after “what happened last time” is never a solid idea, and while we can look back in time, we can not look into the future. There are a lot of things that can affect investor’s decision-making, but ultimately the only thing that is always reliable is current data and active analysis.

At NEST we rely on data and actively manage all of our portfolios in-house, every month of the year – from May to September and the seasons in bewteen. Our process renders our portfolios resilient against myths and biases. For more information, schedule a discovery call with our team by emailing info@nestfinancial.net, and join us on Wednesday Sept 15 at 12:30 PM CST for the free NEST Edge webinar to learn about tapering and what it might mean for the markets.

Find us on:

LinkedIn Facebook Yelp Twitter

DISCLAIMER: We are legally obligated to remind you that the information and opinions shared in this article are for educational purposes only and are not financial planning or investment advice. For guidance about your unique goals, drop us a line at info@nestfinancial.net.

[…] mentioned before that September is historically considered to be the worst month for the stock market, but […]